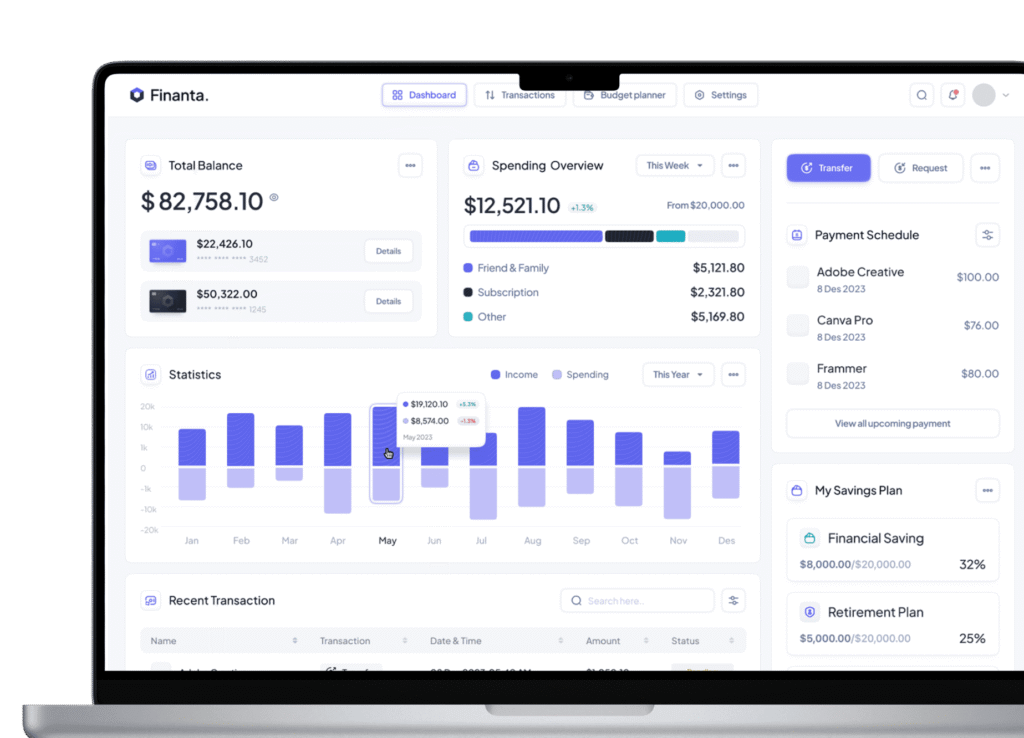

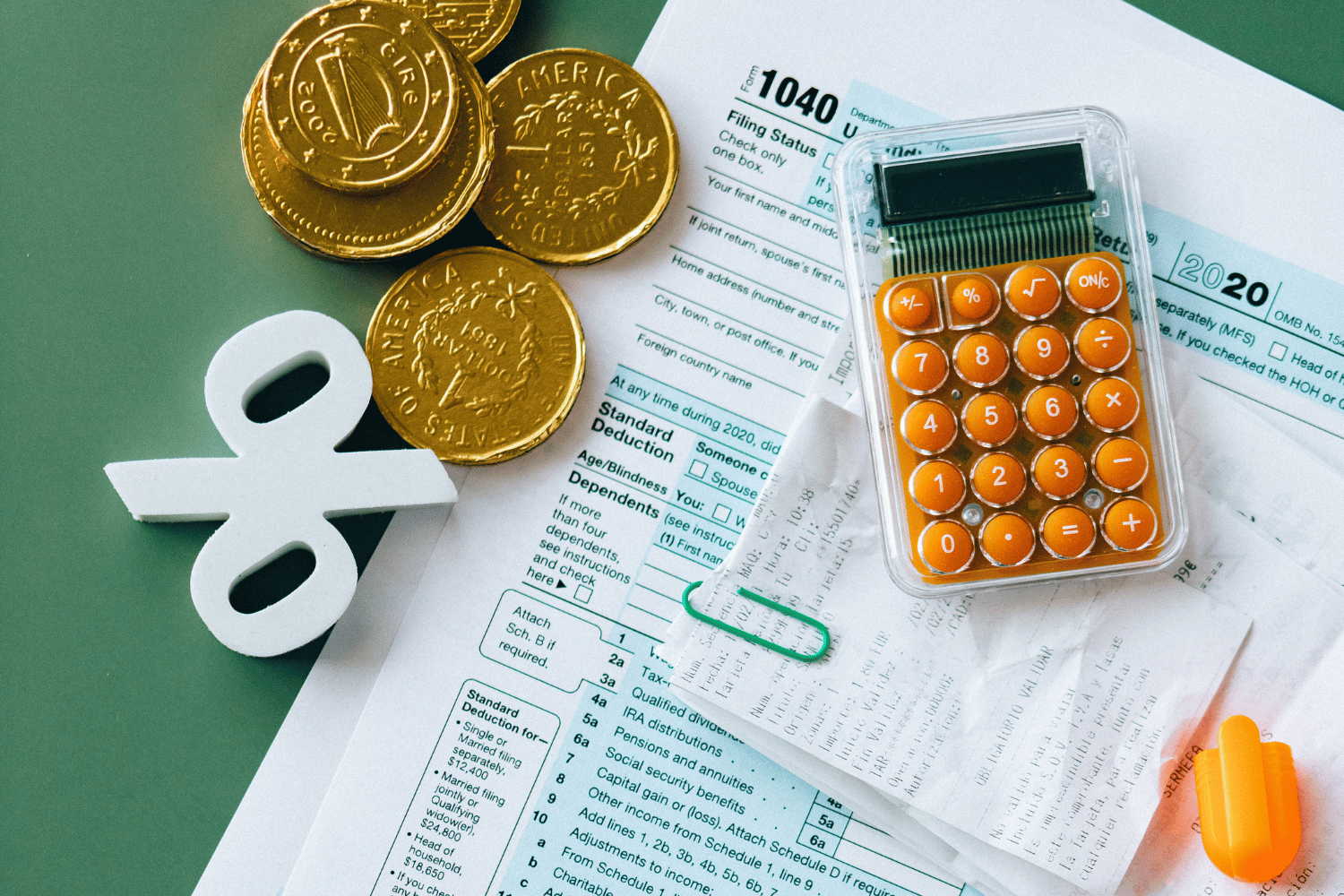

Regular bank reconciliations are your financial safety net, ensuring every transaction matches your records and uncovering discrepancies before they become costly problems. Whether it’s spotting errors, detecting fraud, or simply staying on top of cash flow, this vital process keeps your books audit-ready and your business financially healthy. Our step-by-step guide demystifies reconciliations—from comparing statements to resolving mismatches—so you can maintain clarity, compliance, and control over your finances with confidence.

Google Rating

5.0

based on 492 reviews

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus habitant aptent elementum leo.

Hendrerit montes purus integer suscipit egestas aliquam quisque dictum, enim pellentesque ante, faucibus pharetra ornare aptent habitasse cum.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar leo Feugiat dui in et magnis ligula tortor.